March 2025

Investment update

The March quarter was a challenging period for investment markets, mainly reflecting a new US policy regime. While the focus of this summary is the March quarter, we have also included some comments about more recent developments given their material impact on investment markets.

While the quarter began with a positive tone, it turned negative during the latter part of the quarter. With investors expecting a pro-growth approach from the Trump administration, the S&P 500 rose moderately after the inauguration of Donald Trump on 20 January and peaked on 19 February. During the remainder of the quarter, the US S&P 500 equities index fell by around 10% from its peak to its low point.

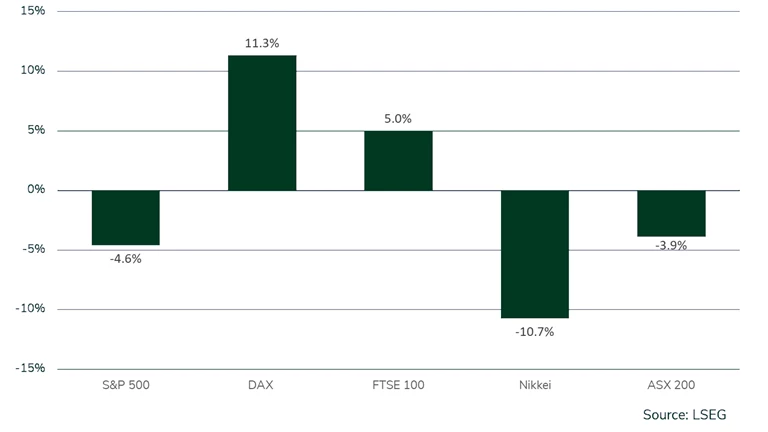

The new policy regime of the Trump administration was a key driver of investment market performance. The performance of global equity markets during the quarter was mixed. While the US, Japanese and Australian markets fell, the German and UK markets experienced gains. The DAX (German market) experienced strong gains, mainly reflecting investors favouring its lower valuations and the potential for more growth because of a relaxation of budgetary constraints.

Equity markets

% price change from 31 December 2024 to 31 March 2025

US policy

Soon after Trump’s inauguration on 20 January, the administration began implementing new policy at a fast pace. While most of the polices had been flagged previously, investors were surprised by the speed and magnitude of change. One of the key policy announcements during the quarter was the US imposing tariffs on Canada, Mexico and China (three of its largest trading partners). Another was the appointment of Elon Musk to run the “Department of Government Efficiency”, with the aim of materially reducing US government outlays.

On 2 April (“Liberation Day”), the US announced reciprocal tariffs on countries that export to the US. The announcement sparked sharp falls in global equity markets, as investors were surprised by the size and rapid implementation of the tariffs. Since that time, there has been a material rebound in equity markets which has reflected factors such as the administration pausing the imposition of the reciprocal tariffs on most countries for 90 days and the large reductions in US tariffs on China.

Investment outlook

At the start of 2025, most analysts expected that the US economy would experience moderate to strong growth this year, with the US Federal Reserve expected to cut interest rates several times. Since January, the outlook has changed materially. The new US policy regime (particularly tariffs) has resulted in a material slowdown in the US economy, with increased inflation pressure. A key driver of the slowdown so far has been weaker consumption growth because of households increasing their saving rate reflecting concerns about the outlook. US consumer confidence and business confidence have fallen materially since the start of the year.

There is considerable uncertainty about the US outlook. If the expectations from the recent consumer and business surveys are realised, the US may experience a recession. Most analysts believe that the probability of recession is higher currently than is typically the case, although the majority do not expect a recession in 2025.

So far, the US tariff policy has had a limited impact on Australia. The current level of “reciprocal” tariffs for Australia is at the minimum level of all countries (i.e. 10%), although Australia will also be impacted by steel and aluminium tariffs of 50%. While the imposition of such tariffs on the Australian economy would be a negative, its overall impact would be relatively small. A potentially more important effect is the impact of US tariffs on global growth.

The Reserve Bank of Australia (RBA) commenced cutting the cash rate to 4.1% in February 2025. It has since cut rates in May to 3.85% reflecting weak growth and inflation falling back to within its targeted range of 2% to 3%. The RBA is likely to cut interest rates further later this year.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.